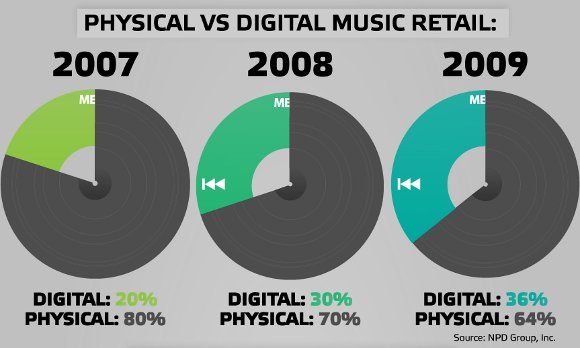

Mint.com, the online financial management tool, has put its numbers together with market researchers NPD Group to analyze music spending. The results: when it comes to consuming recorded music, digital music continues to rise. At the same time, so does Apple’s grip on the music consumption market, a combination that includes proprietary control of a music store, a music player, and the leading mobile device.

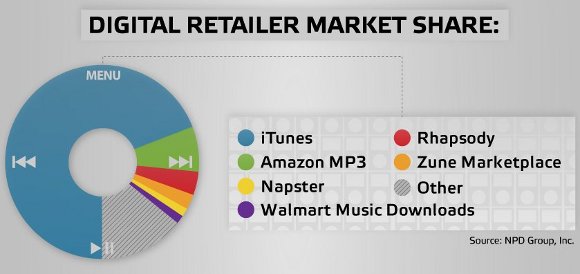

The NPD data should look familiar. Digital music is growing, and clearly it’s at the root of the record industry’s loss of revenue as consumers shift from physical to digital media. Also, Apple’s iTunes remains the lion’s share of the market – enough so that they effectively control distribution, pricing, and consumption patterns, the very definition of monopoly by most measures. (That’s even before you get to Apple’s effective monopoly over the computer player and mobile device, though my suspicion is that an all-out attack on the portable device could start to chisel away at all three.)

Even in the NPD data, though, there’s an interesting indicator: note that the “Other” category is roughly the same size as Apple’s main competitors. That suggests that there’s a plurality minority. And oddly enough, it’s right in the middle of this mysterious “Other” category that a lot of unknown music artists make their dollars, selling direct to listeners or going through niche sites. Artists I’ve talked to in the electronic genre have almost universally said they make nothing on Apple, while they do very well on a site like electronic-specific Beatport. And unlike physical media, it’s not a big deal for someone who loves electronic music to drop their favorite tunes manually from the Beatport store into iTunes and an iPhone.

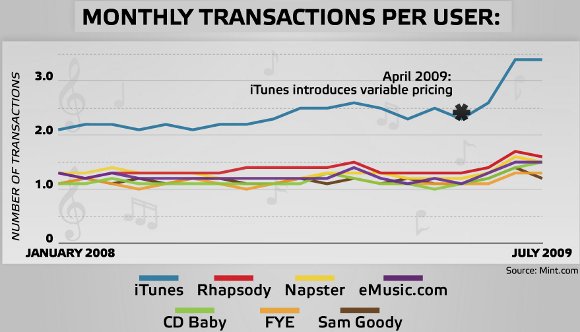

Dig into the Mint.com numbers, and you see just how different stores can be. Per-transaction spending differs by an enormous margin. Brick-and-mortar retailers sell a lot more per transaction. True, this could include accessories like headphones at stores like Sam Goody, but it’s also interesting to note the gap between stores like eMusic, Rhapsody, and CD Baby, and the smaller per-transaction buy at iTunes.

While Apple buyers aren’t spending as much per visit, they’re visiting more often, and Apple’s move to variable has made a big difference. Buyers have gone from purchasing an average of 2-2.5 transactions to well over 3, coinciding with the introduction of variable pricing.

If you’re not a fan of monopolies, there’s just not much to be done to spin this data. As digital consumption has grown by an order of magnitude, nothing has happened – thus far – to change Apple’s dominant share of the market. And as you can see in pricing statistics, within the Apple ecosystem, Apple has been enormously effective in controlling the pricing of the product and spending habits of the consumers.

On the other hand, looking at the inverse situation, a lot of the most interesting activity is happening outside either the former brick-and-mortar or new digital iTunes economies. We don’t have data on a lot of these niche stores (Dancetracks, Beatport, Bleep, and so on), which grow in number and variety. We don’t have data on direct-to-consumer sales by artists. And we don’t have much data on legal free music consumption, music released as Creative Commons or pay-what-you-will. Just criticizing Apple for their popularity could miss out on what’s happening in these alternative channels.

Many of these channels have no obligation to share their statistics, but to any who are interested, I’d love to talk to you. (And I think CD Baby winds up being the most interesting stat here.)

This is also an excellent illustration of what online analytics can do with financial data. It certainly won’t ease anyone who prefers that this data remain private, but fans of analytics might also see potential for collective learning experiences from shared data. Data like this had long been privileged only to banks and credit cards; a service like Mint allows users to share such data with one another.

So, how are you spending on music?

And would you find it useful – or disturbing – to have that kind of data shared anonymously with other consumers?